HOUSTON – The day is unfortunately here; this will be the final issue of the Chickasaw Journal.

HOUSTON – The Houston Fire Department is hosting their annual Fire Academy for Kids this week.

The 10u Cal-Chic All Stars (Cody's Angel's) competed in Batesville in the Dizzy Dean State Tournament where they finished 3rd and the team was…

THORN – The Thorn Volunteer Fire Department has been working for years to build a new station, and now, thanks to a $50,000 appropriation from…

HOUSTON – Officers in the Houston Police Department now have an added layer of protection in the field thanks to a donation made by Chief Adam…

HOUSTON • The Houston Fire Department is always looking for a few good men and women, not only to fight fires, but to do many other jobs assoc…

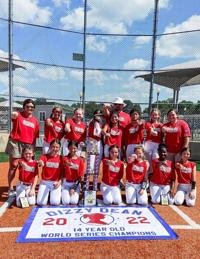

Houston Park and Recreation's "Diamond Divas" competed in the 2022 Dizzy Dean All Star World Series the weekend of July 9-10, 2022 in Southave…

Currently in Houston

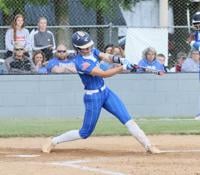

HOUSTON – The Vardaman lady Rams came into this season with one goal, win a state championship, and thanks to Saturday's win, they are halfway there.

HOUSTON – The Houston Lady Toppers’ postseason run came to an end in last Monday’s must-win game three against the West Lauderdale Lady Knights.

VARDAMAN – The Vardaman Rams Baseball Team had an outstanding season, scoring their first divisional championship since 1996, however, that se…

VARDAMAN – The Vardaman Lady Rams Softball Team is headed to the North Half championship following their sweeping round three of the playoffs.

HOUSTON – The Houston Lady Toppers Softball team are still alive in the playoffs, and only one game stands between them and the North Half.

SENATOBIA – The Houston Lady Toppers took to the road to open the second round of the playoffs on Friday night.

VARDAMAN – The Vardaman Lady Rams Softball team took to their home field on Thursday afternoon to open the second round of the 1A playoffs.

Watchdog & Storytelling

The bell is tolling, and I can hear it. It started distant, but now it is upon me.

The desert is expanding in Houston.

When a couple breaks up, one of the most frequent harpoons one person hurls at another goes something like this: “You’re gonna regret you lost me…”

At a seminar some years ago, a newspaper editor declared that if he walked out of his office building and saw a purse-snatcher robbing an unac…

BRANSON, MO. • As the Peanuts character Snoopy once said: "To live is to dance, and to dance is to live."

HOUSTON • It seems like everyone in Chickasaw County knows Wanda and Ed Hancock.

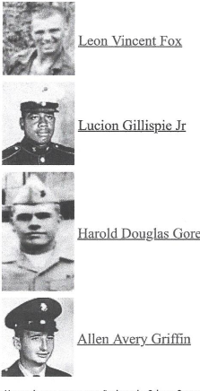

Editor’s note: I’m indebted to Chickasaw County Veteran’s Service Officer Kenneth Nichols, William D. Sykes Post 7149 (Houston) Post Commander…

HOUSTON – Before the Civil Rights Movement and the integration of public schools, and even predating World War II, there was the Chickasaw Cou…

Editor's note: This is an account of a local veteran and his experiences in the Pacific Theater of World War II, which was submitted by a fami…

HOUSTON – The Houston Christmas Parade once again graced the streets of the city last week.

The New Houlka town Christmas parade was held Saturday, Dec. 4 starting 5 p.m., moving from the school administration building onto Highway 32…

HOULKA — Houlka’s mayor and board of aldermen took care of the following items of business during their regular meeting 6 p.m. July 5, at Houl…

OKOLONA – The Chickasaw County Board of Supervisors accepted a warranty deed for the Okolona Courthouse earlier this year, and last week, they…

HOUSTON – The City of Houston voted to adopt a floodplain ordinance last week, a move that could improve the insurance rates of the citizens w…

OKOLONA – The Chickasaw County Board of Supervisors recently approved the 2022 updated Comprehensive Emergency Management Plan.

OKOLONA – The Chickasaw County Board of Supervisors had to modify a bid for Cold Mix asphalt due to the increase in price.

NEW HOULKA — New Houlka’s mayor and aldermen accepted the resignation of Alderlady Kimberly Murphree —the board’s only woman alderman — during…

HOUSTON – The Houston Board of Aldermen heard a proposal from one of their own, Ward 3 Alderman Matt Callahan, pertaining to the community hou…